Posted on May 11, 2019 by Hrishikesh Joshi in AI | Media | Entertainment

A few months back a paper published by Anacondas “Why Your Business Needs an AI Platform” caught my attention.

The Value creation Matrix in the paper describes the impact of AI ($billion) verses share of AI impact in total impact from analytics.

What surprised me here is the impact of AI in Media and Entertainment particularly. According to PWC, the global M&E sector is estimated to be around $2 trillion, while the impact of AI on the sector is estimated to be around $130 billion, which is approximately 6.5% of the total sector size. Just to give you a perspective the estimated Global TV Advertising revenues in 2019 just around 9% of the total industry size.

The story does not end there, of all AI advancements expected to take place in this sector, 47% will take place within the next 3 years, which means companies have started investing heavily in this sector to find that competitive advantage. Its NOW more than ever!

Companies are already challenging the status quo by building systems that track real-time viewership at a much granular level, content analysis using computer vision, blockchain and much more, all using AI, delivering great value to the stake holders. While M&E has multiple verticals, TV still is a major source of information in many countries, India being one of them.

Of the total industry size of $24 billion in 2018, TV still contributes to 44%. According to a report published by ET, TV still shows a strong growth of 7.6%, with over 66% penetration in India. South Indian states have even higher penetration of up 90%.

TV Landscape in India

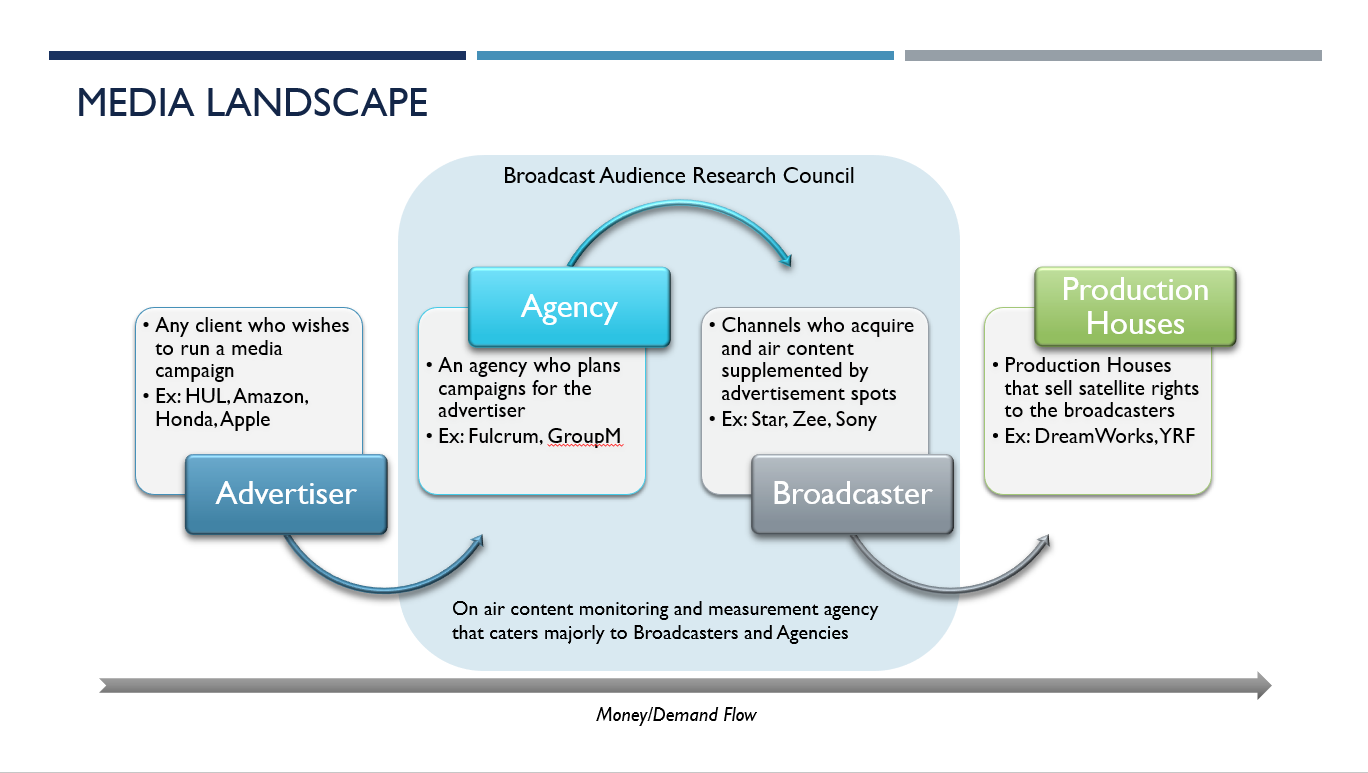

TV media in India has 5 major stakeholders. Starting from left are the advertisers followed by the agencies, broadcasters, production houses and a centralized rating agency Broadcast Audience Research Council (BARC).

Typically, money flows from left to right, where an advertiser sub-contracts its media planning duties to an agency, who plans an optimized media mix for their client. Agencies typically work on a 10-15% commission. Broadcasters, who own TV channels either acquire or produce content which is consumed by viewers like you and me. Even today Indian TV Industry heavily relies on advertising revenue (41% – 2018) as oppose a lot of foreign countries where ad revenues are much lower.

BARC through its licensed software “BARC Media Workstation” (BMW) distributes viewership data to its users-typically Agencies and Broadcasters.

Methodology of Data Capturing

BARC has measurement units strategically placed across various households throughout the country. Readings from these units are extrapolated to give the best possible estimation for the population viewership. There are currently around 40000 BARC meters across India capturing TV viewing behaviour for 835 Mn individuals. After pre-processing the data, it is delivered to the consumers via BMW approximately 10 days after the actual capturing.

Problem with Decision Making

One of the many problems with this methodology is the delayed data delivery. Since the data is not available with the agencies during the campaign planning phase which happens much before airing of the content, this gives room for a lot of “gut-feel” decision making. A lot of times this kind of decision making does not bode well for the advertisers.

Just to give you a perspective how big the problem is,

Assume that only 10% of all the TV advertising spends went wrong i.e. they delivered only 50% of the expected viewership. Therefore INR 30.5 billion was misplaced, however since it delivers 50% of the expected then we say INR 15 billion was misplaced which is roughly the size of the entire Music Industry.

Why does this Problem exist?

Over last couple of months of my entrepreneurial journey, I met quite a few veterans of the Industry. While most of them agreed that the problem exists, very few have actually gone out of the way to build a sustainable solution. We saw that unlike industries like e-commerce the inertia seems very high in Media. I guess this explains the fact that while the world is moving towards RPA AI and ML, India Media is still fixated on Excel for daily chores. One of the major reasons is that for a major part of life, the industry been deprived of data and have learned to do things in the presence of nothing. It’s only been 4 years since BARC came into existence that stakeholders have pivoted towards understanding viewership basis numbers alone and not perception.

Our Role

At Ven Analytics we believe in the power of data and its only through leveraging data can an organization become truly sustainable and disruptive. To help organizations achieve this mission we use an approach called Rapid Solution Development (RSD).

In order to deal with many small problems, we need many small solutions. Just like Nano-bots. To start with we build a Machine Learning solution for the Hindi Movie Segment. The uncertainty of how much a movie will deliver for a TV audience has been bugging stakeholders for a long time. Our Movie dashboard, “Movie Wizard” not only predicts how much would a movie deliver when it is aired on TV it also gives other statics around the movie to help them take a better planning decision.

Another such solution is centred around cricket, which contributes to around 69% sports viewership in India, which in turn attracts the major share of advertising pie. Which tournaments would generate higher viewership? Which matches do we look forward to? etc. are some of the questions we try to answer using ML. Our Cricket dashboard “Target Score” gives a compressive perspective on the viewership, ad spends (seconds) and other parameters on upcoming tournaments. These two solutions are just the tip of the iceberg. The possibilities are endless.

Our ultimate objective is to have every stakeholder upraised with quality information, making sure that he takes the most informed and data-accurate decisions. We believe that this is only possible through RSD wherein we work closely with the stakeholders and not only develop solutions for them but also enable them to become self-sustained in the long-run.